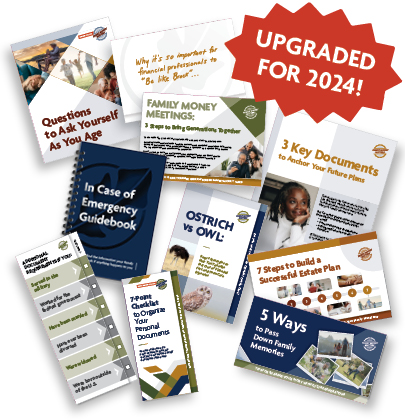

Making a meaningful impact with client families means delivering value beyond just consistent return on investments. In fact, what you do outside of their investments can make a genuine difference. It's about going beyond the call of duty for your clients, preparing them for life's unexpected storms and weaving a network of support. Your complimentary Preparing Client Families for the Future toolkit contains 10 upgraded guides to help you steer client families through many common situations—especially as family members grow older. |

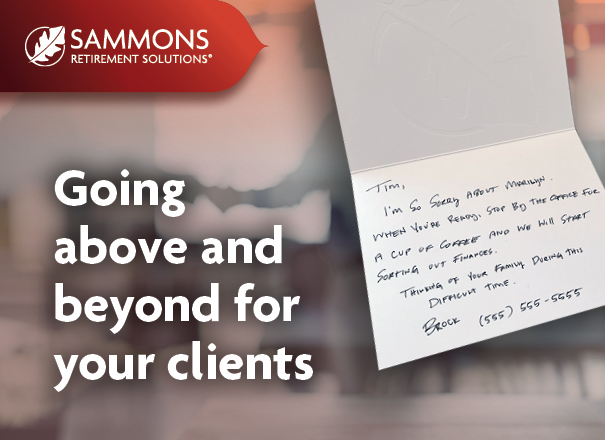

See how a handwritten note helped a client’s family discover their financial lifeline |

|

|

Facing a challenging case? Call our Sales Desk at 855-624-0201 for successful strategies other financial professionals have used.

As independent financial professionals, it is up to you to choose whether any of the sales concepts contained in these materials might be appropriate for use with your particular sales strategy and clients. Please note that Sammons Retirement Solutions® does not require you to use any of these sales concepts; they are resources that can be used at your option for your own individualized sales presentations if appropriate for the particular client and circumstances.

You must be a Registered Representative and your Broker/Dealer must have an agreement with Sammons Financial Network®, LLC., member FINRA, in order to receive materials.

Securities distributed by Sammons Financial Network®, LLC., member FINRA. Insurance products are issued by Midland National® Life Insurance Company (West Des Moines, IA). Sammons Institutional Group®, Inc. provides administrative services. Sammons Financial Network®, LLC., Midland National® Life Insurance Company and Sammons Institutional Group®, Inc., are wholly owned subsidiaries of Sammons® Financial Group, Inc. Sammons Retirement Solutions® is a division of Sammons Institutional Group®, Inc.

Sammons Institutional Group®, Inc. and Sammons Financial Network, LLC., member FINRA, do not give tax, legal, or investment advice. Please have your client consult with and rely on their own tax, legal, or investment professional(s). Taxes are payable upon withdrawal of funds, and a 10% IRS penalty may apply to withdrawals prior to age 59½.

NOT FDIC/NCUA INSURED, MAY LOSE VALUE INCLUDING LOSS OF PRINCIPAL, NO BANK/CU GUARANTEE, NOT A DEPOSIT, NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY.

FOR INSTITUTIONAL USE ONLY. NOT INTENDED FOR CONSUMER SOLICITATION PURPOSES.

3876178

36226R-59351 REV 10-24