Want more? Have questions about Sammons Retirement Solutions, need a hypothetical illustration, or want to talk through options on a tough-to-close case?

We're here to help.

Phone: 855-624-0201

Email: sdadmin@sfgmembers.com

Filter by

Topic:or

Company:

|

Six barriers to investment success presentation Full presentation for the brochure "Six barriers to investment success." |

|

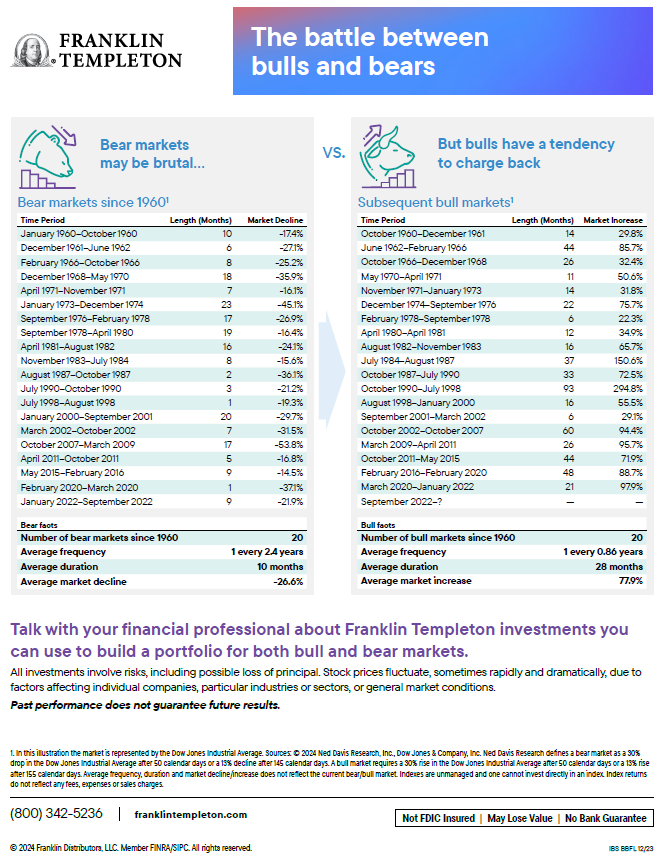

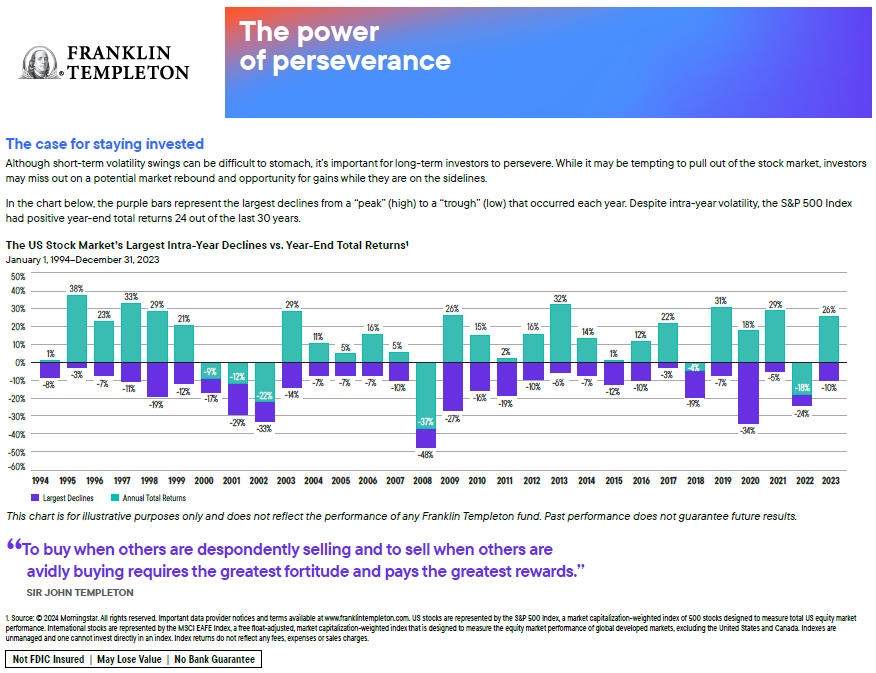

The Power of Perseverance Although short-term volatility swings can be difficult to stomach, it's important for long-term investors to persevere. |

|

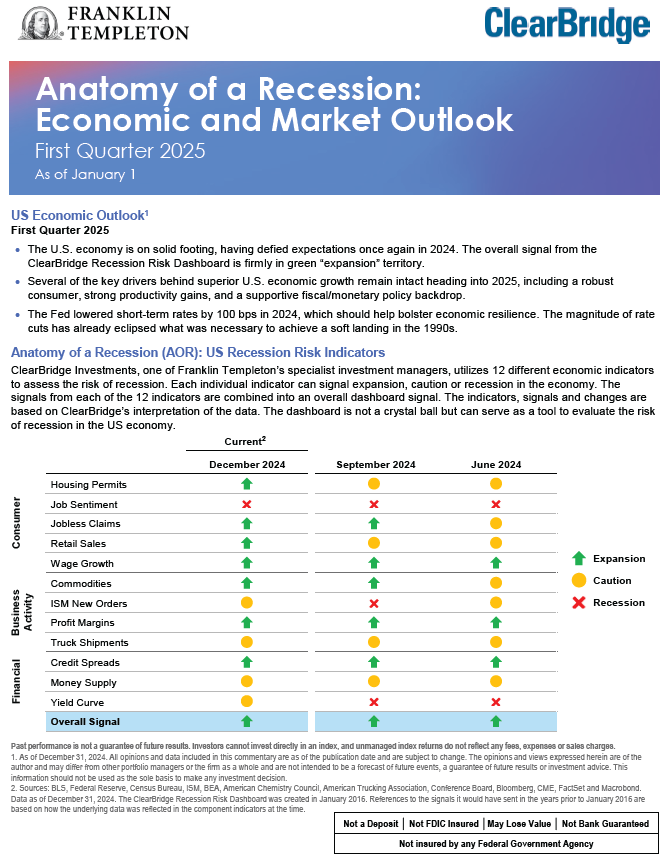

The Anatomy of a Recession Flyer A supplemental flyer to the Anatomy of a Recession presentation. This flyer is a quick breakdown of the risk indicators and how they apply now and in the near future. |

|

Final wishes and ethical will A supplemental piece for the Heir Preparation Packet. This form allows the owner to record beliefs, wishes, and guidance to a beneficiary. |

|

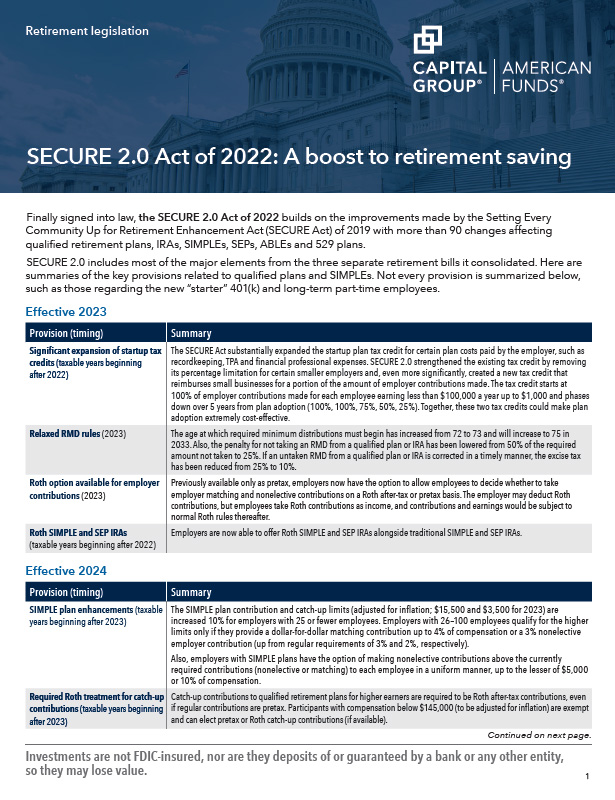

Retirement Plan Overview Reference Guide A guide comparing a Traditional IRA, Roth IRA, SEP, SIMPLE IRA, 403(b)(7), and 401(k). Includes information on taxable income and plan contribution limits. |

|

Bonds Are Back An update on Bonds and the opportunities they provide in enhancing an annuity. Compare the history of Bonds to their current state, and how they can be an added asset. |

|

Managing Stress for Success A presentation on the strategies to prepare for, respond to, and evolve your experience with stress. |

|

Modern Prospecting How do you create the ultimate client experience? Prospecting of the future depends on focusing on customer journeys at specific touchpoints and measuring the client experience. |

|

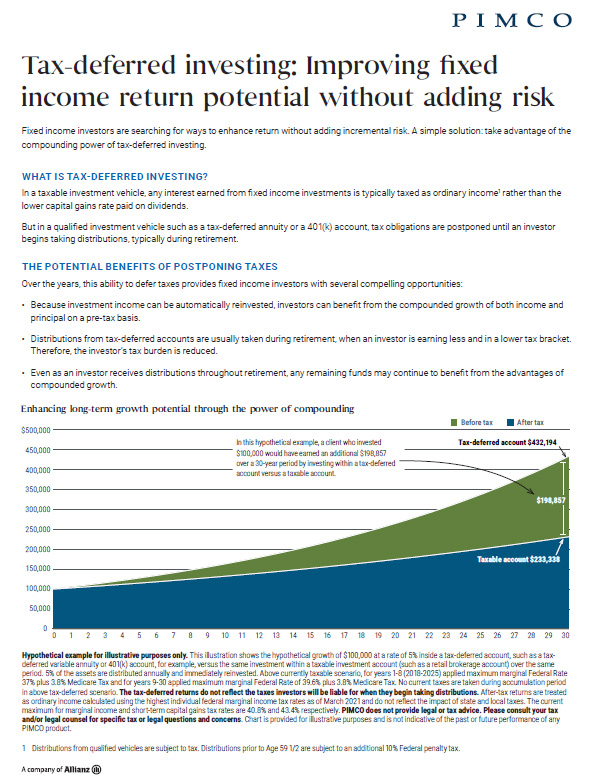

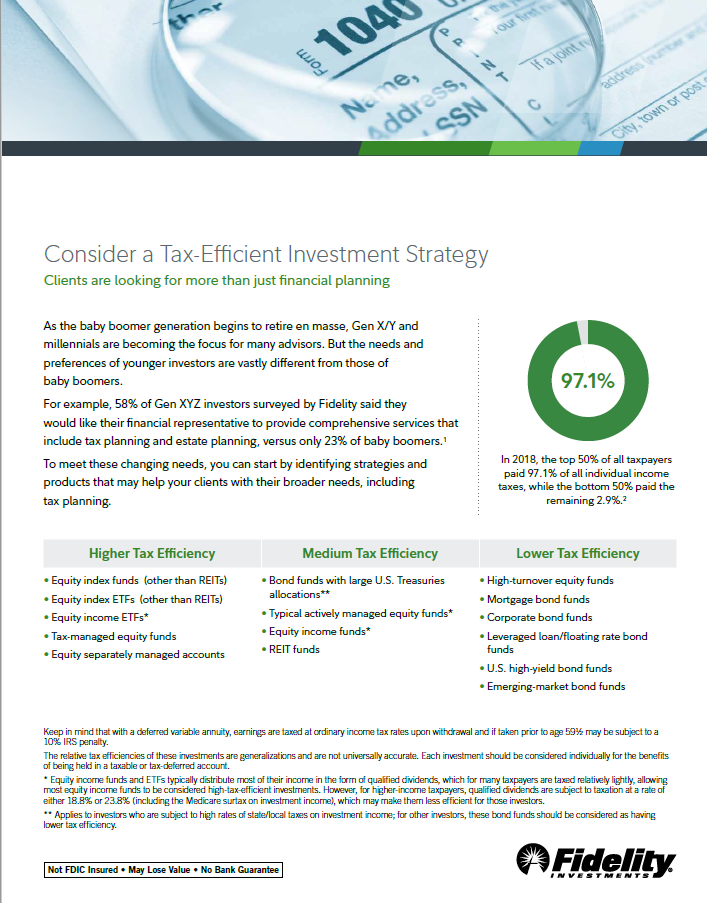

Adopt a Tax-Efficient Investment Strategy Tax laws have resulted in higher taxes for many. Now may be a good time to develop an investing strategy to help reduce your tax liability. |

|

Long-Term Perspective on Markets and Economies This is an outlook on the global economy provided by American Funds. |

|

Seven Things You Need to Do in the Decade Before You Retire Retirement is approaching. Learn the seven things you need to do to help make sure you're ready for retirement. |

|

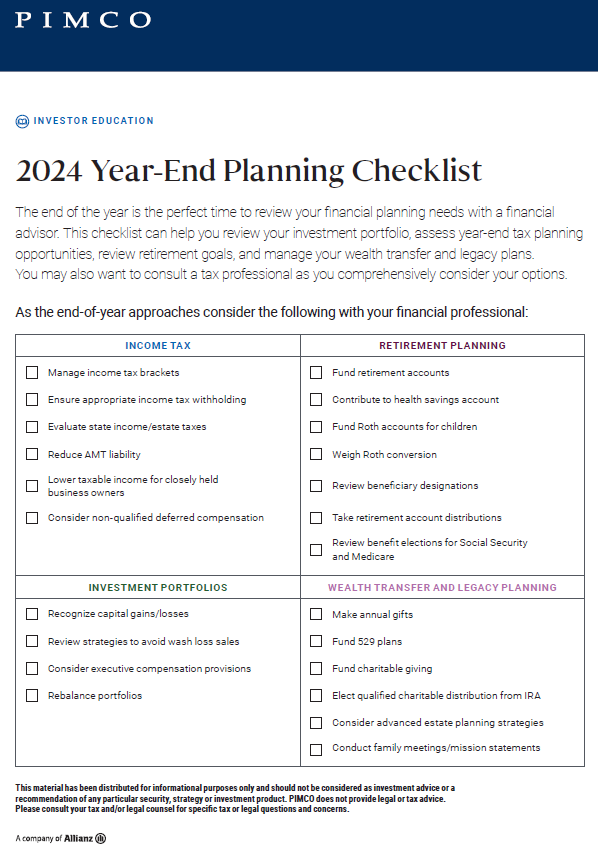

Year-End Planning Strategies Checklist It's important to consider a variety of your clients' planning needs. Use this list to review actionable strategies for clients, checking off topics as you go. |

|

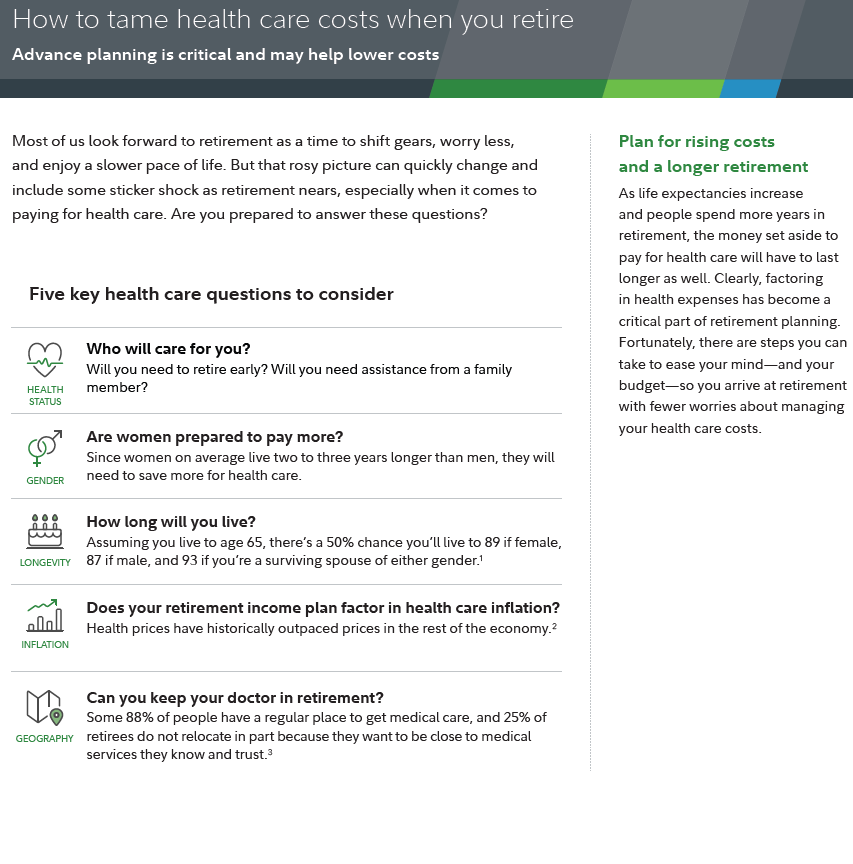

Planning for Health Care in Retirement An investor presentation to help plan for health care and medical expenses in retirement. |

|

How to Tame Health Care Costs When You Retire This white paper covers the need for advance planning and how it may help lower costs. |

|

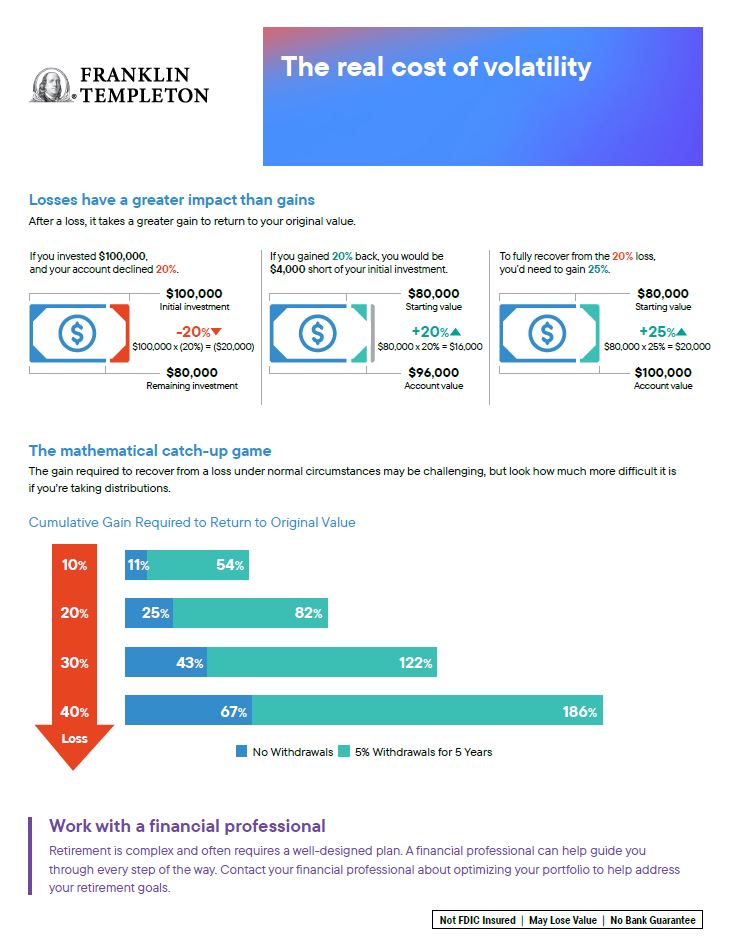

The Real Cost of Volatility This piece graphically shows the gain needed to return to original value after a loss. |

|

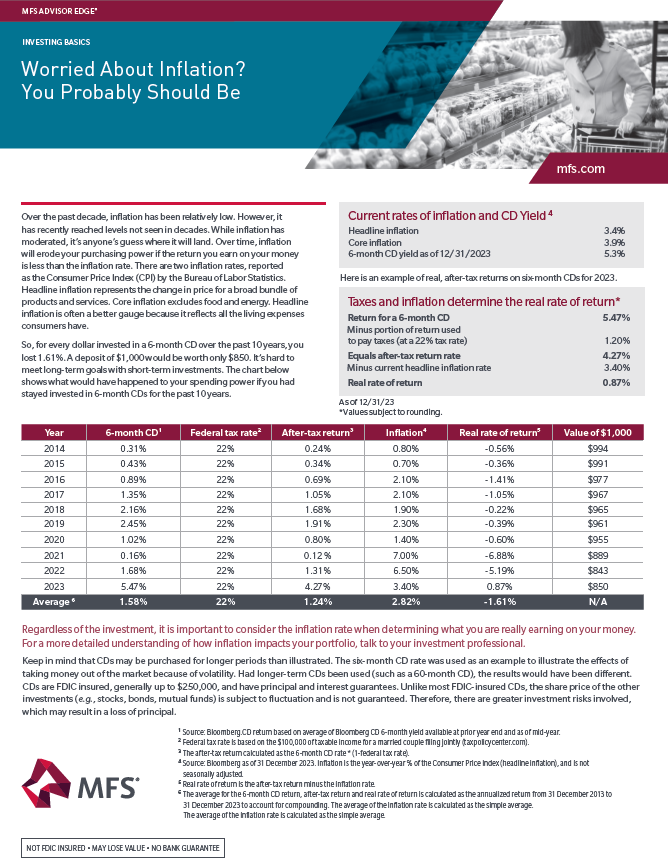

Worried About Inflation? Many investors cite inflation as one of their primary worries. Over time, inflation will erode purchasing power if the return earned is less than the inflation rate. |

|

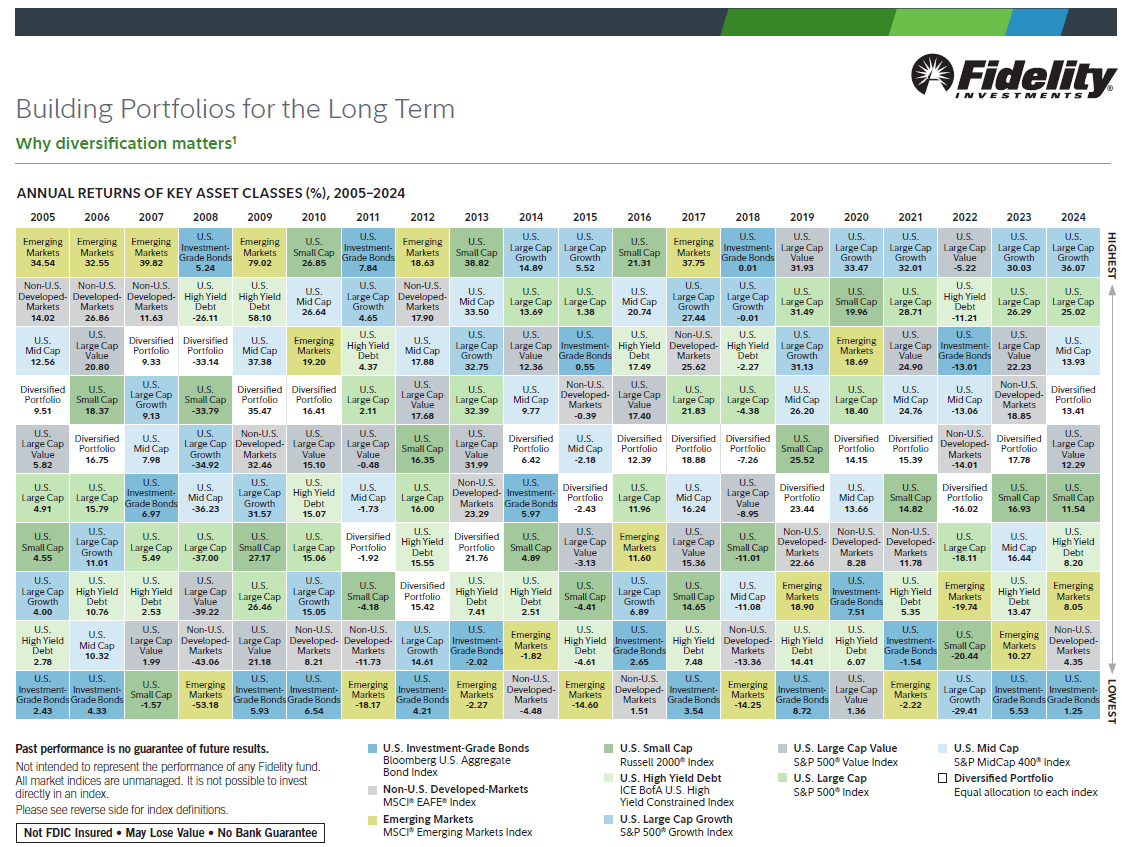

Why Diversification Matters This document contains annual returns of key indices from the last 20 years. |

|

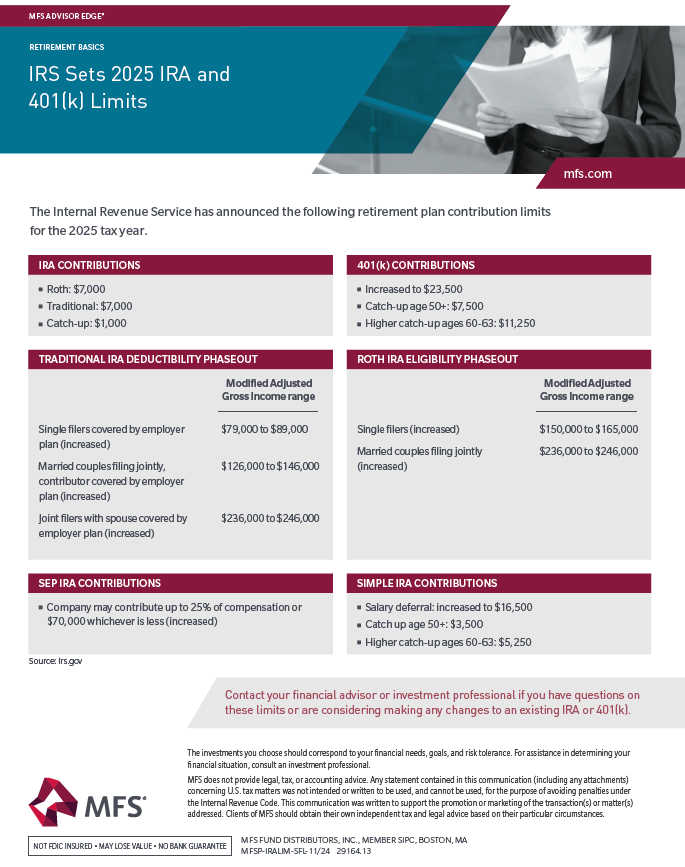

IRA and 401(k) Limits The Internal Revenue Service's (IRS) retirement plan contribution limits for this tax year. |

|

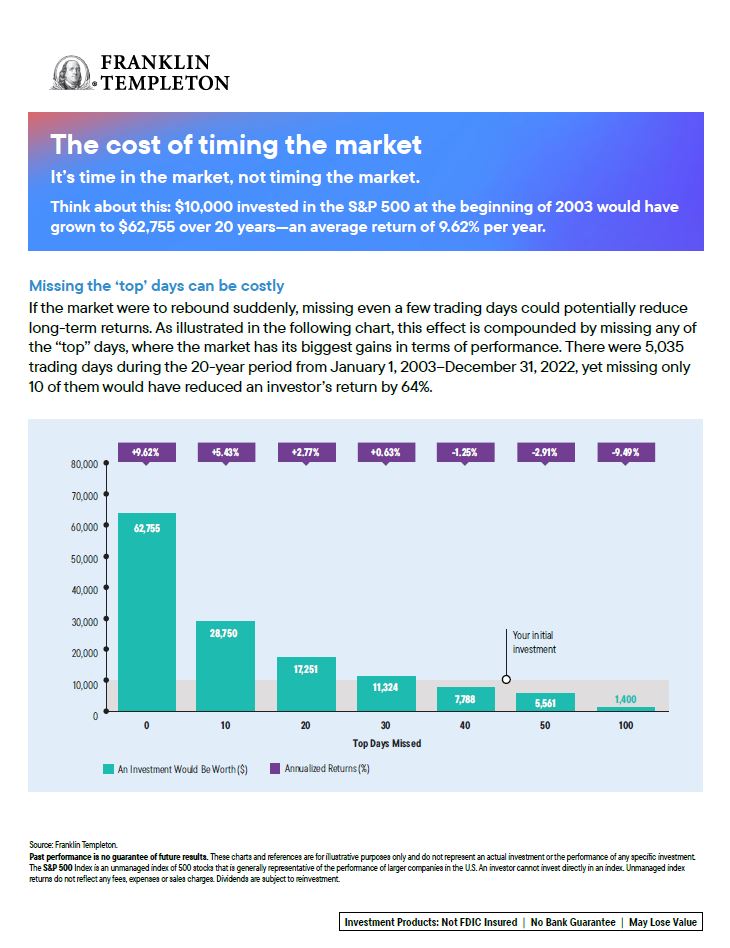

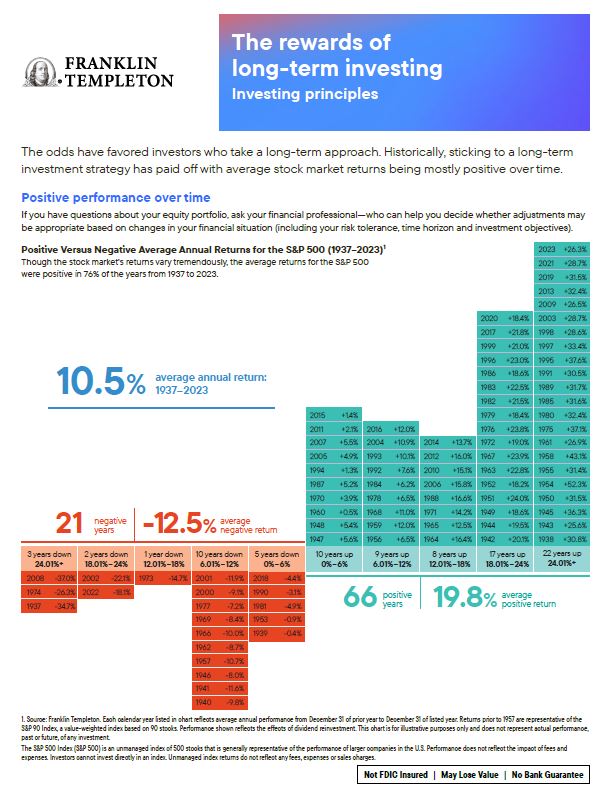

The Rewards of Long-Term Investing The odds have favored the investor who takes a long-term approach. This piece helps demonstrate why it can pay to stay invested. |

|

The Intergenerational Divide: A Bridge to the Next Generation A presentation designed to provide you with new ideas and insights on connecting with the future generations of your most valued clients. |

|

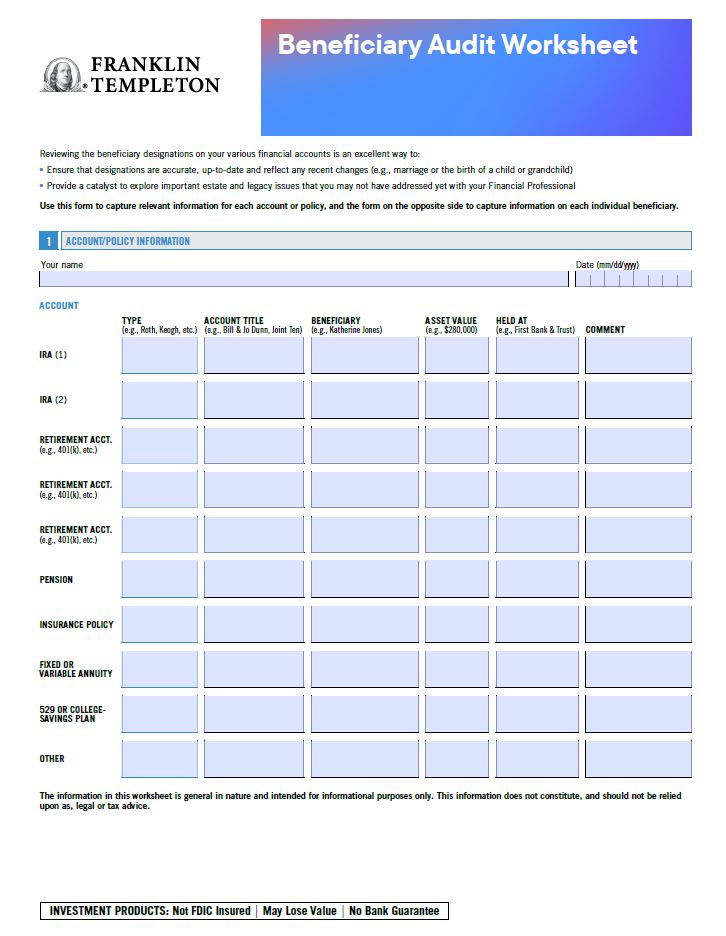

Beneficiary Audit Worksheet Use this form to capture relevant information for each account or policy and each individual beneficiary. |

|

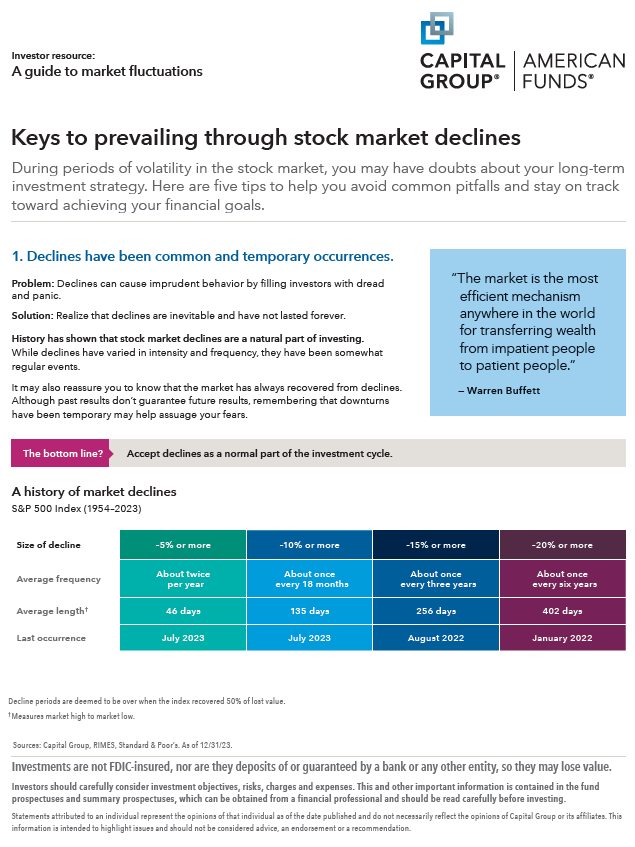

Long-Term Investors Can Weather Market Declines This chart shows the history of intrayear declines and annual price returns in the S&P 500 over the course of 70 years. |

|

Mastering the Client Review Ideas to help take client reviews to the next level and expand existing client relationships. |